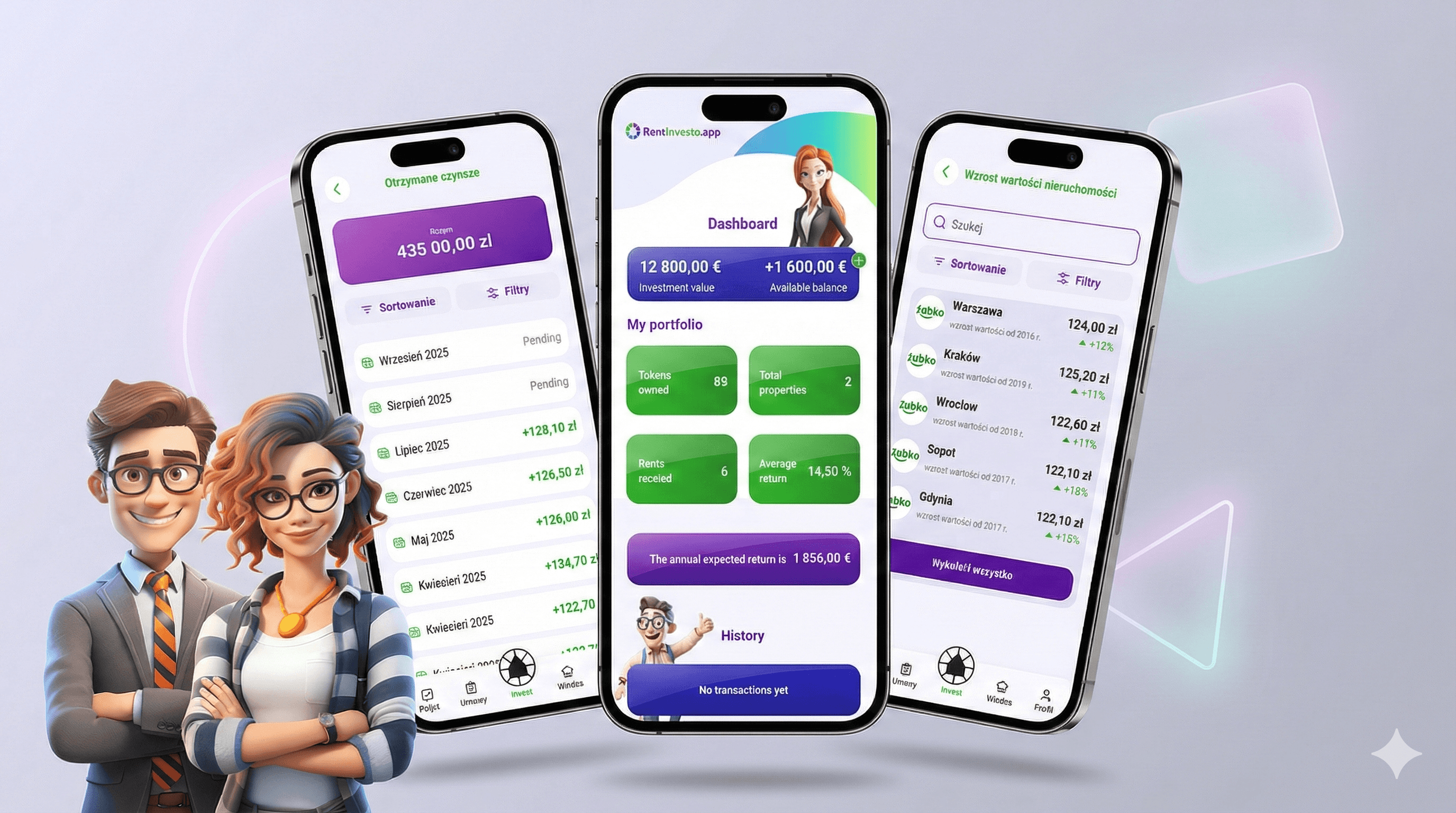

RentInvesto — Real Estate Investment, as Simple as a Bank Deposit

RentInvesto

/

Fintech / Real Estate

/

MobileDevelopmentUI/UX

Industry

Fintech / Real Estate

Scope

Frontend, backend, mobile app, infrastructure, admin panel, KYC and payment integrations

Role

Full platform development from scratch

Scale

1200+ users · Thousands of downloads · 4.5/5 stars · Hundreds of thousands PLN invested

Key takeaways

01 / Mobile-First in Fintech

Financial apps must work perfectly on mobile — that's where users make decisions.

02 / Compliance From Day One

In financial applications, regulatory compliance must be built in, not added later.

03 / Greenfield Has Advantages

A project from scratch allows building the right architecture without compromises and technical debt.

04 / AI as Enhancement, Not Replacement

An AI assistant can make platform interaction easier, but it doesn't replace solid technical foundation.